新语丝北京翻译公司田老师说,授信协议翻译是指银行向非金融机构客户直接提供的资金,或者对客户在有关经济活动中可能产生的赔偿、支付责任做出的保证。

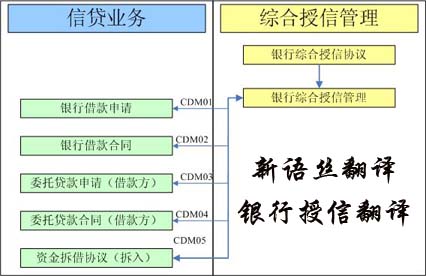

新语丝北京翻译公司田老师指出,授信协议翻译包括贷款协议翻译、贸易融资协议翻译、票据融资协议翻译、融资租赁协议翻译、透支协议翻译、各项垫款协议翻译等表内业务。

新语丝北京翻译公司田老师说,根据“银行授信协议翻译工作尽职指引”,授信协议翻译指对非自然人客户的表内外授信。表内授信包括贷款、项目融资、贸易融资、贴现、透支、保理、拆借和回购等;授信协议翻译按期限分为短期授信协议翻译和中长期授信协议翻译。短期授信协议翻译指一年以内的授信,中长期授信协议翻译则是一年以上的授信。

新语丝北京翻译公司田老师指出,授信协议翻译可分为以下类型:

1、 个人授信协议翻译

2、 商业授信协议翻译

3、 银行授信协议翻译

4、 综合授信协议翻译

授 信 协 议 翻 译

(适用于流动资金贷款不再另签具体合同的情形)

编号:

授信人:

主要负责人:

授信申请人:

法定代表人/主要负责人:

经乙方申请,甲方同意向乙方提供授信额度,供乙方使用。现甲方与乙方按照有关法律规定,经充分协商,就下列条款达成一致,特订立本协议。

第1条 授信额度

1.1 甲方向乙方提供 人民 币 XXX 元整(含等值其他币种,汇率按各具体业务实际发生时甲方公布的外汇牌价折算,下同)的授信额度。其中(以下打“√”选择):√循环额度 人民币xxx元;□一次性额度 币 元。

循环授信额度是指授信期间甲方为乙方提供的可连续、循环使用的贷款、贸易融资、票据贴现、商业汇票承兑、保函、法人账户透支、国内保理、 删去 、 删去 等授信本金余额之和的最高限额。

一次性授信额度是指授信期间乙方向甲方逐笔提出叙做多笔授信业务的申请,各笔授信业务的累计发生额不得超过本协议规定的一次性授信额度金额。乙方不得循环使用一次性授信额度,乙方申请叙做的多笔授信业务相应金额占用本条规定的一次性授信额度金额,直至累计占满为止。

“贸易融资”包括开立信用证、进口押汇、提货担保、进口代收押汇、打包放款、出口押汇、出口托收押汇、进/出口汇款融资、短期信保融资、进口保理、出口保理(无追索权双保理、甲方系统内无追索权双保理除外,下同)、 删去 、 删去 等业务品种。

Credit Agreement (Version of 2011)

(Applicable to a working capital loan, for which no contract is required)

No.:

Creditor:

Chief Responsible Officer:

Credit Applicant:

Legal Representative/ Chief Responsible Officer:

Upon application by Party B, Party A agrees to grant a credit line to Party B for its business purposes. This Agreement is entered into by and between Party A and Party B through negotiation on a sufficient basis in accordance with applicable laws; therefore, IT IS HEREBY AGREED AS FOLLOWS:

Article 1 Credit Line

1.1 Party A grants Party B a credit line in an amount of RMB XXX only (including equivalents in other currencies, to be converted at a foreign exchange rate published by Party A at the time of actual transaction; the same as below). Please mark “√” for an intended option as follows: √ Revolving line in an amount of RMB XXX;□ Lump-sum line in an amount of RMB [●]

“Revolving Line” means a maximum line of balance of credit principals, granted to Party B by Party A during the Credit Term, covering continuous and revolving loans, trade financing, discounted notes, commercial acceptance drafts, L/G, overdraft of corporate account, domestic factoring, etc.

“Lump-sum Line” means that Party B applies to Party A for credits installment by installment during the Credit Term, and all the credits in accumulation shall not exceed the lump-sum line hereunder. Party B is not allowed to apply the lump-sum line, and each credit applied by Party B shall be accounted for the lump-sum line hereunder, until such lump-sum line is used up.

“Trade Financing” shall include business categories such as letter of credit, import bill negotiated, lading guarantee, import documentary collection, packing loan, B/P, export collection bill purchased, import/export remittance financing, short-term credit insurance financing, import factoring, export factoring (double non-recourse factoring; unless there is no such double non-recourse factoring in system of Party A; the same as below).

|